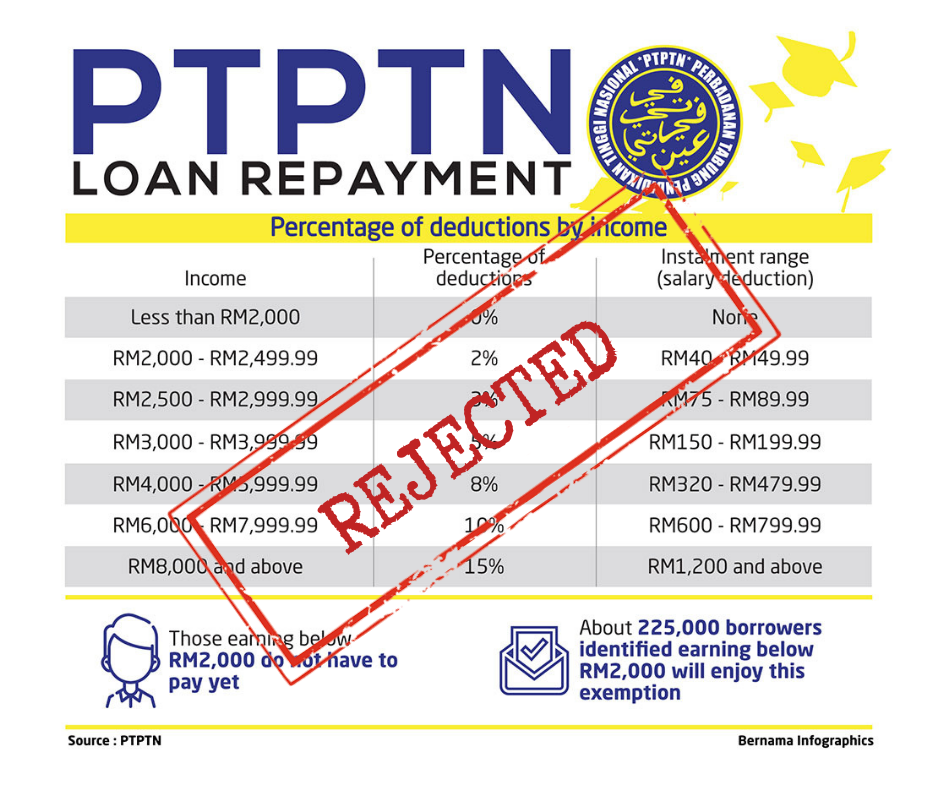

In response to the recent announcement by PTPTN dated 6th December 2018, where the government institution responsible for alleviating burden of education financing announced its new loan repayment scheme, Demokrat UM is appalled by the level of burden the new scheme imposes on students and graduates who took up the loan.

While the concept of Income-Contingent Loan is nothing foreign, the academic circle, at least in terms of student debt, has argued for an ICL structure where the maximum percentage that should be taken out of an individual’s income to be eight percent (Hock-Eam L. et al., 2014). This is due to the rising cost of living, especially in Malaysia where household essentials such as cooking oil saw a price hike of 49.1% (Imoney, 2017). The reintroduction of SST makes things worse, never mind the fact that a household needs at least RM 1043 spare in its income to be able to finance a house (A.M. Yusof et al., 2015).

What is clear from the release is PTPTN’s inconsideration of living expenses and commitments of its lendees, especially considering that the scheme is effective next year even for those who signed under the former ujrah agreement (Where repayment amount is fixed over a period of time). Where the scheme hits most are not fresh graduates who are still trying to figure out their place in the world, but young working adults, those with long-term financial commitments and very little money to spare at the end of the month.

It is ironic that the social media post came with the hashtag #PTPTNPrihatin. If the body was aware of the fact that having an RM 8000 salary does not mean you will always have RM 1200 leftover, especially in an ill economy where living costs is at all-time high, this repayment scheme would not have come to conception.

Yesterday, the Education Minister announced that the new Income-Contingent Loan Repayment(ICLR) enforcement will be postponed. We acknowleged that this postponement is due to voices of dissent and effort to keep the current government in check. In participatory democracy, check and balance by the citizens are pivotal.

Sources :

Hock-Eam L., Ismail R., Ibrahim Y. (2014) The Implications of Graduate Labor Market Performance in Designing a Student Loan Scheme for Malaysia. In: Chapman B., Higgins T., Stiglitz J.E. (eds) Income Contingent Loans. International Economic Association Series. Palgrave Macmillan, London

Yusof A.M., Chai C.S., Johan J. (2015) Housing Affordability Among Potential Buyers in the City of Kuala Lumpur, Malaysia. In: Shen L., Ye K., Mao C. (eds) Proceedings of the 19th International Symposium on Advancement of Construction Management and Real Estate. Springer, Berlin, Heidelberg